Protect your business against unpaid invoices and trade safely.

Unpaid invoices – get protection with credit insurance

Credit insurance protects your business from the risks of non-payment of invoices. This means your invoices are covered. So if your customer can’t pay you, you’ll still get your money.

The best credit insurers get to know you and your business. They work in partnership with you, supporting you with up-to-date intelligence on markets and sectors. You can use this information to help explore new markets with confidence and offer competitive credit to customers. It also gives you a layer of security that banks tend to like when approached for finance.

We’re one of the world’s leading providers of credit insurance. Let us introduce ourselves, and learn more about Atradius, at www.atradius.sg

Credit insurance has allowed us to open up credit terms with foreign customers. In the past we’ve required a letter of credit or prepayment which has turned some customers away.

Operations Manager

Small business wholesale distribution

How credit insurance works

You can use credit insurance as a tax-deductible business service. It can be a requirement of your management board and you might find it a great support when seeking finance from banks. Credit insurance is suitable for most businesses, from SMEs to large multinationals. It can be used for both domestic and export trade.

Stage 1

Agree on a credit limit with your customer

With credit insurance

Without credit insurance

Little to do

Your insurer will work with you and research your customers.

Get a credit limit for your buyer from your insurer.

(A credit limit is the maximum amount of insurance cover available to you on a customer).

Atradius as the insurer has access to valuable data on your customers at their disposal.

Lots of work

Do your own research or pay for an agency.

Employ a credit agency to check your buyer. Choose to either:

- Take the hit if your customer fails to pay

- Make your customer get a Letter of Credit from their bank

- Outsource the invoicing to a factoring company.

Stage 2

Deliver your goods and submit your invoice

With credit insurance

Without credit insurance

Focus on your work

One less thing to worry about

Just do what you do best.

Deliver your goods or services, send your invoice and get on with your business.

Cross your fingers

Trust in your luck and hope your customer pays.

Depending on what you did in Stage 1 you can:

- Submit your invoice and hope for the best

- Submit your invoice to the factoring company

- Submit your invoice and meet terms of Letter of Credit (such as gathering evidence of goods or services delivery)

Stage 3

Customer Bankrupt!

With credit insurance

Without credit insurance

No problem

Your insurer will work with you to sort it out.

Customer can’t pay? Let your insurer know and they’ll settle up; either through debt recovery or a pay-out.

This could hurt

Any way you look at it, it's a loss.

Unpaid invoices? Depending on what you did in Stage 1 this means:

- Self-insured? Ouch!!

- Factored? You’ll get paid but check the small print, your next invoice might have different terms

- Letter of Credit? Gather all evidence. Miss a bit of evidence and you could miss a lot of money.

Stage 4

What's next?

With credit insurance

Without credit insurance

You'll get paid

Claim back almost all outstanding debt.

There’s nothing to see here. Your business operates as usual. Return to Stage 2 and continue as before.

No money and lots of work

Find a good lawyer. You'll need one.

Take the hit and see your profits reduced. Return to Stage 1 and start the process over. Bear in mind factoring and Letters of Credit terms may be different as a result of the debt.

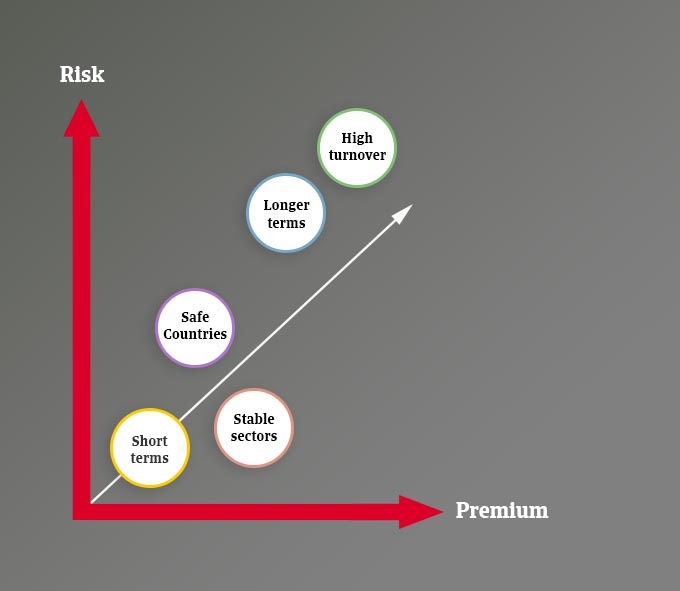

How your premium is calculated

Pricing is based on a small percentage of your annual sales depending on a number of factors.

Factors that affect your premium

Turnover

The premium is calculated on the turnover multiplied by the premium rate which is mostly below half a percent.

Sector

Some sectors experience greater market volatility. Risk will be reflected in the premium, with sectors closely monitored for change.

Credit

The amount of time you allow your customer before they have to pay you is factored into the premium.

Countries

Whether through infrastructure, politics or conflict, some countries pose less trading risk than others. Your premium allows for this.

Examples are for illustration only. Individual risk factors are identified, assessed and monitored for each policy.

Get in contact

If you have any questions or need advice regarding credit insurance for your business we can help. We provide credit insurance for businesses around the world ranging from start-ups and SMEs to large multinationals.

We are where you are. We’re present in more than 50 countries and work from more than 160 offices worldwide.

Book a meeting by filling in the form. Our expert advisors will help you get the necessary cover, appropriate for your needs.

Instead of blindly going into a relationship with a new customer, we can leverage the information Atradius has in its database to approve credit on potential new customers before the first order ever ships. This gives us a level of security that we wouldn’t otherwise have.

CEO

Small Business Wholesale Distribution company

Learn More